Gambling Losses Agi

- Gambling Losses In Pa

- Gambling Losses Irs

- Gambling Losses Against Winnings

- Gambling Losses In 2019

- Deduct Gambling Losses Against Winnings

- Gambling Losses Irc

- Can You Claim Gambling Losses Against Wins

Gambling winnings, even if there’s a net loss for the year, and game show winnings can increase the cost of health insurance premiums for low-income individuals or families who obtain their insurance through the Marketplace and, in some cases, those enrolled in Medicare coverage.

We all know how tangled a web our tax laws are, and adding Obamacare to the equation has created this oddity.

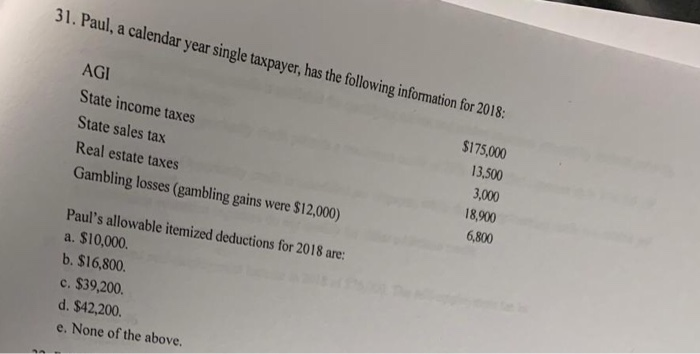

Although the Chief Counsel Advice Memorandum (CCAM 2008-011) introduced the concept of “gambling sessions,” which essentially nets winnings and losses for those who follow the required record keeping rules, taxpayers generally cannot net their winnings and losses on their tax returns. The total gambling winnings are included in the adjusted gross income (AGI) for the year, and while the losses are deducted as an itemized deduction and limited to an amount not exceeding the reported winnings for the year.

Thus, whether or not a taxpayer itemizes deductions and deducts their gambling losses, the full amount of the gambling winnings is included in their AGI; their AGI is used to determine their household income, which in turn is used to determine the amount of premium tax credit (PTC) to which the taxpayer is entitled. The higher the income, the lower the PTC, and the lower the PTC, the higher the insurance premiums.

If gambling winnings exceed certain thresholds based on the type of the taxpayer’s gambling and the amount won, then the casino, poker palace or racetrack is required to send the taxpayer and the IRS a Form W-2G that shows the winnings, so you can be sure the IRS will be aware of their gambling income. Even if losses for the year exceed the taxpayer’s winnings or the taxpayer doesn’t receive a W-2G form, the IRS expects winnings to be reported, which will increase the taxpayer’s AGI and likely also their Marketplace-purchased insurance premiums.

Similarly, if a taxpayer wins goods on a game show, the taxpayer may also receive a W-2G, adding to their AGI for the year. Even if they give any of the goods to charity, that would, like gambling losses, be an itemized deduction.

Gambling Losses In Pa

Losses are allowed as an itemized deduction dollar for dollar against the gain. Gambling losses cannot be greater than gambling wins for the tax year. Example: John wins $23,500 during the year playing slots and other casino games. His gambling losses are $37,900. Gross gambling income is reported on page one of Form 1040, while gambling losses are a miscellaneous itemized deduction (not subject to the 2%-of-adjusted-gross-income (AGI) limit). Taxpayers often believe their winnings are immune from reporting unless they receive a Form W-2G.

Gambling Losses Irs

Although impacting very few, the scenario also applies to taxpayers on Medicare. An individual’s Medicare B and D premiums are based on their AGI from two years prior. Thus, a taxpayer who had gambling winnings from two years back could see increases in both their monthly Medicare B premiums and supplement for the Medicare D (prescription drug coverage). However, the Medicare premium increase generally impacts higher-income individuals who can more easily deal with the increased costs.

It’s been a while since I’ve listed out the bad states for gamblers. Here’s an updated list. Make sure you read the notes because while all of these states have tax systems that are problematic for gamblers, some impact amateurs while others impact professionals. Note that I do not cover the laws that impact gambling here (such as Washington State’s law that makes online gambling a Class C felony).

Connecticut [1]

Hawaii [2]

Illinois [1]

Indiana [1]

Massachusetts [1]

Michigan [1]

Minnesota [3]

Mississippi [4]

New York [5]

Ohio [6]

Washington [7]

West Virginia [1]

Wisconsin [1]

Gambling Losses Against Winnings

NOTES:

1. CT, IL, IN, MA, MI, WV, and WI do not allow gambling losses as an itemized deduction. These states’ income taxes are written so that taxpayers pay based (generally) on their federal Adjusted Gross Income (AGI). AGI includes gambling winnings but does not include gambling losses. Thus, a taxpayer who has (say) $100,000 of gambling winnings and $100,000 of gambling losses will owe state income tax on the phantom gambling winnings. (Michigan does exempt the first $300 of gambling winnings from state income tax.)

Gambling Losses In 2019

2. Hawaii has an excise tax (the General Excise and Use Tax) that’s thought of as a sales tax. It is, but it is also a tax on various professions. A professional gambler is subject to this 4% tax (an amateur gambler is not).

Deduct Gambling Losses Against Winnings

3. Minnesota’s state Alternative Minimum Tax (AMT) negatively impacts amateur gamblers. Because of the design of the Minnesota AMT, amateur gamblers with significant losses effectively cannot deduct those losses.

4. Mississippi only allows Mississippi gambling losses as an itemized deduction.

Gambling Losses Irc

5. New York has a limitation on itemized deductions. If your AGI is over $500,000, you lose 50% of your itemized deductions (including gambling losses). You begin to lose itemized deductions at an AGI of $100,000.

Can You Claim Gambling Losses Against Wins

6. Ohio currently does not allow gambling losses as an itemized deduction. However, effective January 1, 2013, gambling losses will be allowed as a deduction on state income tax returns. Unfortunately, those gambling losses will not be deductible on city or school district income tax returns, so Ohio will remain a bad state for amateur gamblers.

7. Washington state has no state income tax. However, the state does have a Business & Occupations Tax (B&O Tax). The B&O Tax has not been applied toward professional gamblers, but my reading of the law says that it could be at any time.